London is lastly getting a correct check of its urge for food for loss-making, high-growth know-how shares. The impending initial public offering of cybersecurity startup Darktrace Plc fulfills most of the standards that much-hyped Deliveroo Holdings Plc didn’t, however buyers are nonetheless being requested to miss some points that might doubtless be much less of a priority within the U.S.

Deliveroo’s expertise made it more durable to gauge U.Okay. buyers’ enthusiasm for progress corporations. They balked on the dual-class shares, which gave Chief Govt Officer Will Shu management over the meals supply firm, and the enterprise’s dependence on poorly paid gig employees. Its market debut was a catastrophe, and the inventory continues to commerce 30% under its itemizing worth.

In contrast, Darktrace is a loss-making however fast-growing, high-gross margin software program enterprise that may stick with Britain’s predilection for one share, one vote. And a spate of latest high-profile hacks has underscored the significance of excellent cybersecurity.

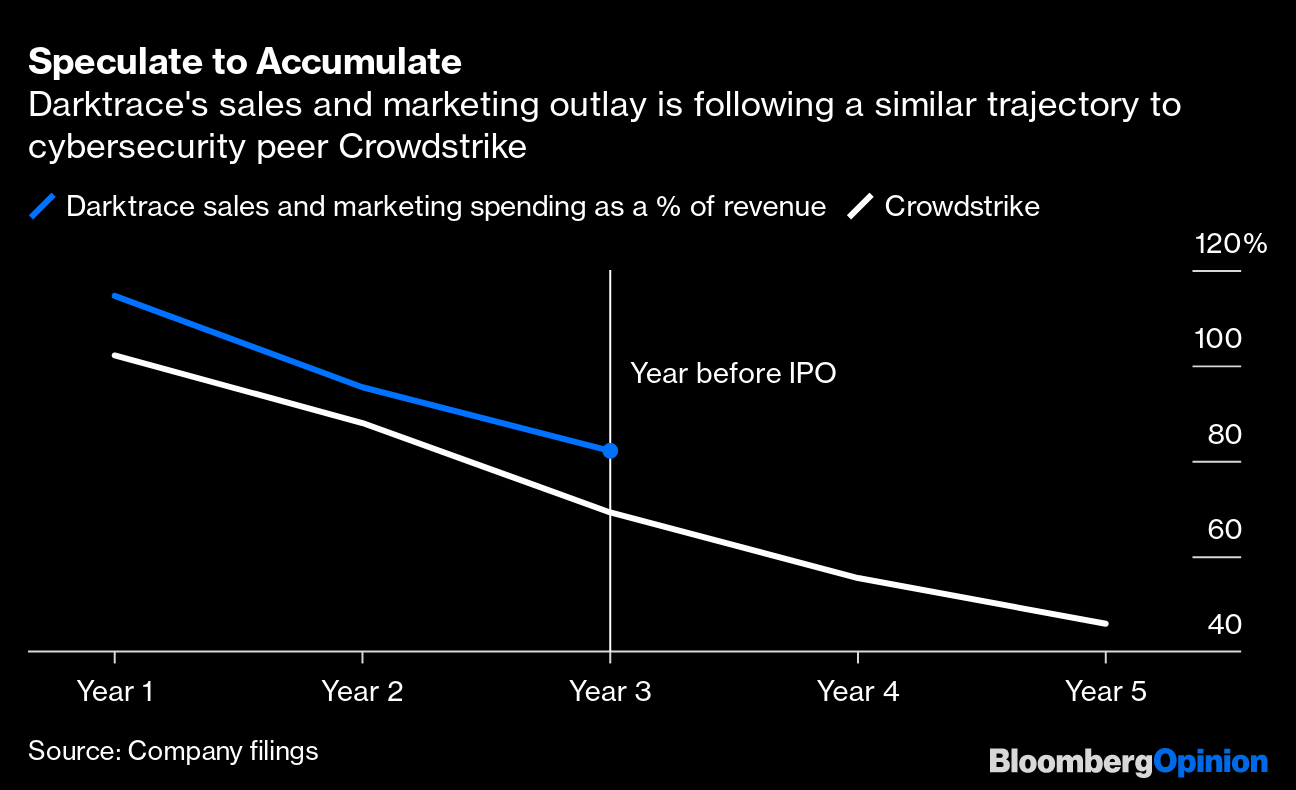

The Cambridge, England-based firm is mimicking the method of software-as-a-service pioneers similar to Salesforce.com Inc., spending closely on gross sales and advertising and marketing to drive early adoption of its merchandise, which in Darktrace’s case makes use of a strand of synthetic intelligence known as machine studying to identify incursions into prospects’ networks.

Chief Govt Officer Poppy Gustafsson spent 82% of income on gross sales and advertising and marketing final 12 months — nary a shiny enterprise journal nowadays comes and not using a Darktrace advert — and the corporate has nearly 5 occasions as many individuals working in gross sales because it does in analysis and improvement.

Some wrinkles within the funds counsel Gustafsson could should work onerous to persuade buyers that the mannequin, which is tried and examined within the U.S., will yield outcomes. Regardless of excessive spending on the gross sales drive, the tempo of progress slowed final 12 months. The 45% income enhance to $199 million nonetheless represents a large bounce, however a 12 months earlier it rose 73%. In the meantime, the corporate boasts that its goal market is value some $40 billion.

Evaluate that with best-in-class peer Crowdstrike Holdings Inc. It equally spent a median of 75% of income on advertising and marketing within the three years earlier than its IPO, however the California-based agency doubled gross sales annually, and has since maintained the identical progress trajectory.

Speculate to Accumulate

Darktrace’s gross sales and advertising and marketing outlay is following an identical trajectory to cybersecurity peer Crowdstrike

Supply: Firm filings

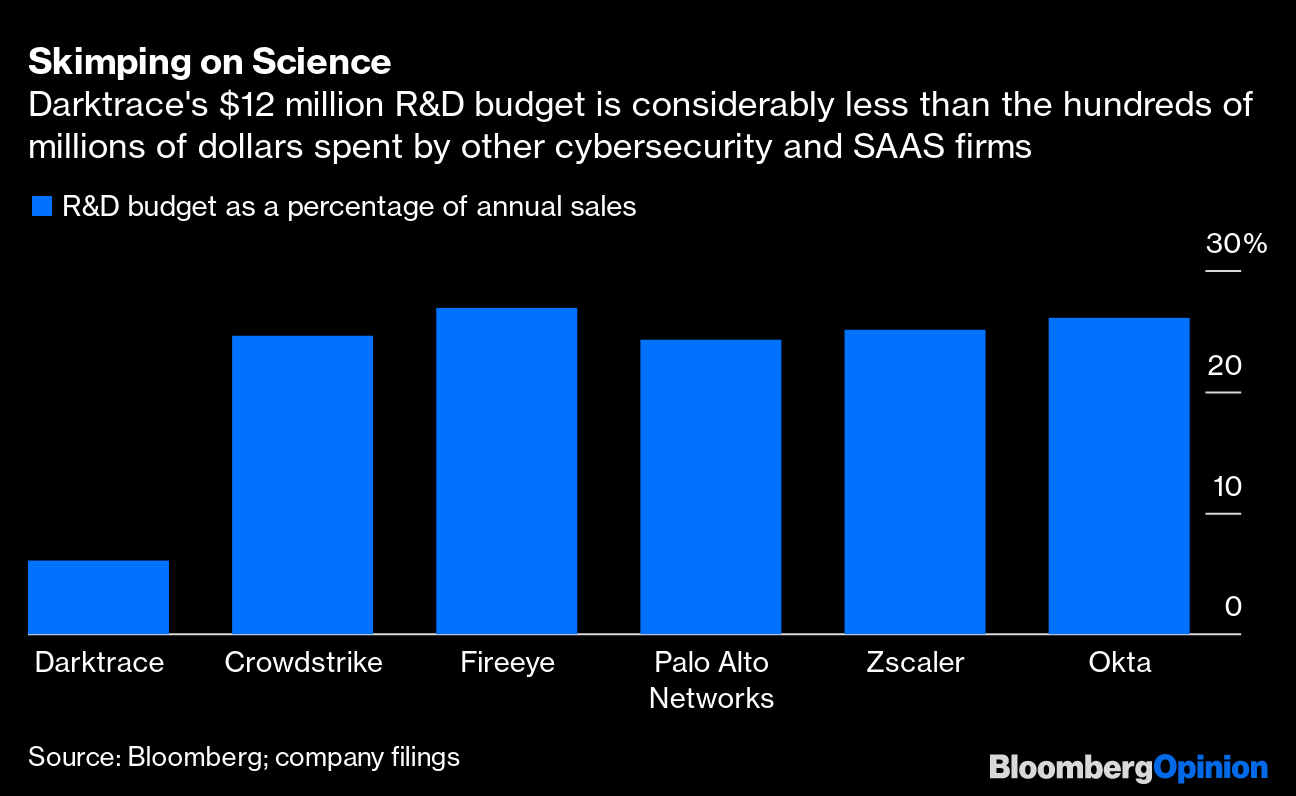

Darktrace’s slackening progress could also be as a result of pandemic, since its gross sales groups rely closely on in-person pitches and commerce occasions to flog their wares. However it might additionally level to shortcomings within the product itself. The corporate spends remarkably little on R&D: The $12 million finances final 12 months represented simply 6% of income. Whereas Gustafsson plans to extend that to between 10% and 13% of gross sales, that’s nonetheless lower than the 25% that cybersecurity friends usually spend on innovation.

Skimping on Science

Darktrace’s $12 million R&D finances is significantly lower than the a whole bunch of thousands and thousands of {dollars} spent by different cybersecurity and SAAS corporations

Supply: Bloomberg; firm filings

Darktrace argues that it has decrease prices as a result of its providing depends on AI and its analysis groups are based mostly in Cambridge, the place bills are decrease than Silicon Valley. However its core product workforce, led by Dave Palmer, who previously labored at U.Okay. intelligence companies MI5 and GCHQ, should develop quickly to construct the options that may let it compete. There are already many rivals within the so-called community evaluation and visibility market, together with Vectra AI Inc., VMWare Inc.’s Lastline, FireEye, ExtraHop Networks and Cisco Techniques Inc., in accordance with Forrester analyst Paul McKay.

This 12 months’s first-quarter monetary efficiency ought to be illuminating. The recent cyberattacks on the U.S. authorities should have accentuated the necessity for higher cybersecurity and may have supplied an earnings tailwind.

Not like Deliveroo, Darktrace does seem to be taking a suitably cautious method to its valuation: The mooted market capitalization of between $three billion to $four billion would characterize about 18 occasions trailing income on the midpoint. That’s a reduction to New York-listed shares that exhibit comparable progress charges however decrease proportionate advertising and marketing spend — Crowdstrike is valued at 53 occasions trailing income.

However there’s additionally wariness about Darktrace’s hyperlinks with Autonomy Corp. founder Mike Lynch, who’s fighting extradition to the U.S. over allegations of fraud. Darktrace says he now not performs any energetic function on the firm, however Lynch was an early investor and can personal 19% of the inventory along with his spouse. The authorized points could have been a much bigger threat had the itemizing been in New York.

Tech corporations often bemoan how London buyers shun shares which might be high-growth however loss-making. Darktrace is a extra credible candidate than was Deliveroo. If it slips up too, then the ramifications for London’s efforts to draw sizzling tech listings can be much more extreme.

This column doesn’t essentially mirror the opinion of the editorial board or Bloomberg LP and its homeowners.

To contact the editor accountable for this story:

Nicole Torres at ntorres51@bloomberg.net

Author: ” — www.bloomberg.com ”